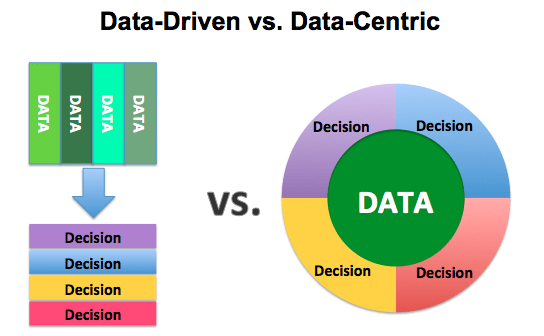

Data-Driven vs. Data-Centric Firm

Top 7 Characteristics of A Data-Centric Firm

A data-driven investment firm typically possesses the following key characteristics:

01. Data-Enabled Decision-Making:

Data-driven institutions make decisions based on robust data analysis and insights, enabling more informed and strategic choices across all levels of the organization.

02. Advanced Analytics Capabilities:

These institutions leverage advanced analytics tools and techniques to extract valuable insights from large and complex datasets, uncovering trends, patterns, and opportunities.

03. Client-Centric Approach:

Data-driven institutions use client data to personalize services, improve experiences, and anticipate client needs, leading to higher satisfaction and loyalty.

04. Risk Management Excellence:

Data analytics help these institutions identify and manage risks effectively by assessing creditworthiness, detecting fraudulent activities, and complying with regulatory requirements.

05. Operational Efficiency:

Data-driven decision-making streamlines internal processes, reducing inefficiencies and optimizing resource allocation for enhanced operational performance.

06. Innovation and Agility:

These institutions leverage data to drive innovation, develop new products, and respond swiftly to market changes, staying ahead of industry trends and customer demands.

07. Continuous Learning Culture:

A data-driven culture promotes ongoing learning, skill development, and data literacy across the organization, ensuring that employees can effectively use data to inform their actions and strategies.

How Can Cognivo Help the investment management industry?

Data Strategy Design & Implementation

A well-defined data strategy is essential for leveraging data as a strategic asset to drive business growth, make informed decisions, and gain a competitive advantage. Cognivo is helping the investment management industry develop and implement a robust data strategy. Here’s how Cognivo is assisting the investment management industry with data strategy:

01. Assessment and Alignment:

We starts by understanding your organization’s goals, objectives, and current data practices. Then we assess the existing data infrastructure, processes, and culture to identify strengths and weaknesses. This assessment helps us align the data strategy with your business goals.

02. Defining Data Objectives:

We work with your organization to define clear data objectives. These objectives could include improving decision-making, enhancing customer experience, optimizing operations, or enabling innovation. Clearly defined objectives guide the entire data strategy development process.

03. Data Governance:

Establishing proper data governance is essential for data strategy success. We will define data ownership, access controls, data quality standards, and compliance requirements. We also develop policies and procedures for data management.

04. Data Architecture:

We then design an appropriate data architecture that aligns with your business needs. This includes selecting the right data storage solutions, databases, data warehouses, and data lakes. We also ensure that data is stored in a structured and accessible manner.

05. Data Integration:

Financial institutions often have data silos, where data is stored in different systems that don’t communicate effectively. We will integrate these systems to ensure seamless data flow across the organization. This integration is crucial for holistic data-driven decision-making.

06. Data Analytics and Insights:

Using our proprietary tools, we will set up analytics frameworks and tools to derive meaningful insights from data. This might involve choosing the right data analytics platforms, building dashboards, and developing predictive and prescriptive analytics models.

07. Data Privacy and Security:

In today’s data-centric world, ensuring data privacy and security is paramount. We can help your institutional investment firm comply with relevant data protection regulations, implement security measures, and manage data breaches effectively.

08. Change Management:

Adopting a new data strategy often requires changes in organizational culture and workflows. We will help you manage these changes by providing training, workshops, and communication strategies to ensure that employees understand and embrace the new data-driven practices.

09. Technology Recommendations:

Based on your institutional investment firm’s requirements, we will recommend suitable data tools and technologies. This might include data integration tools, analytics platforms, machine learning frameworks, and more.

10. Measurement and Monitoring:

We will establish key performance indicators (KPIs) to measure the success of your data strategy. They set up monitoring systems to track progress toward your data objectives and make adjustments as needed.

11. Continuous Improvement:

Data strategies are not static; they need to evolve as your institutional investment firm grows and the data landscape changes. We will help you establish a framework for continuous improvement, ensuring that your data strategy remains effective over time.

Data Readiness Design & Implementation

Data readiness involves preparing and optimizing data for effective use in analytics, decision-making, and strategic initiatives. Here’s how Cognivo is assisting the investment management industry with data readiness:

01. Assessment and Audit:

We will conduct a thorough assessment of your existing data landscape, including data sources, formats, quality, and accessibility. This audit helps identify gaps, inconsistencies, and areas that need improvement.

02. Data Strategy Alignment:

We will ensure that your data readiness efforts align with your overall business goals and objectives. They help define the purpose and desired outcomes of data readiness initiatives.

03. Data Governance:

We will develop data governance frameworks, policies, and procedures to ensure data quality, security, privacy, and compliance.

04. Data Quality Enhancement:

We will identify and rectify data quality issues such as missing values, inaccuracies, duplications, and inconsistencies. We will also implement data cleansing and enrichment processes to improve the reliability of your data.

05. Data Integration:

Integrating data from various sources is often complex. Our team will design and implement data integration strategies to ensure seamless and accurate data flow across systems, reducing data silos.

06. Data Transformation:

We will transform raw data into usable formats for analysis. This involves data normalization, standardization, and enrichment, making it more suitable for reporting and analytics.

07. Data Cataloging and Metadata Management:

We will organize and catalog your data assets, creating a metadata repository that provides valuable context about the data, making it easier to search, discover, and understand.

08. Data Security and Compliance:

Data readiness includes ensuring data security and compliance with relevant regulations (e.g., SEC, FINRA, etc). We will implement security measures, access controls, and data masking techniques.

09. Data Architecture Design:

We will design scalable and flexible data architecture that accommodates future growth and changing data needs. This includes selecting appropriate databases, data warehouses, and data lakes.

10. Technology Evaluation and Implementation:

We will select and implementing data tools and technologies that best suit your data readiness goals. This might involve data integration platforms, data quality tools, and more.

11. Data Lineage and Traceability:

We will establish data lineage, documenting the origin, transformations, and flow of data. This enhances transparency and accountability, critical for compliance and decision-making.

12. Change Management and Training:

Preparing your team for data readiness changes is crucial. We will provide training, workshops, and change management strategies to ensure smooth adoption of new data practices.

13. Measurement and Continuous Improvement:

We will define key performance indicators (KPIs) to measure the effectiveness of data readiness efforts. They establish monitoring mechanisms and continuously refine processes for ongoing improvement.

14. Data-Driven Culture:

We will help you promote a data-driven culture within your organization, fostering an environment where data is valued, used, and trusted across all levels.

Data Architecture Design & Implementation

We have been providing expertise and assistance in developing, refining, and optimizing data architecture for the investment management industry of various sizes and business requirements. Here’s how Cognivo is assisting the investment management industry with data architecture:

01. Assessment and Analysis:

We start by assessing your institutional investment firm’s current data architecture, systems, and processes. They identify strengths, weaknesses, and areas for improvement.

02. Business Alignment:

We will work closely with stakeholders to understand your institutional investment firm’s business goals, objectives, and data-related challenges. They align the data architecture strategy with your specific business needs.

03. Requirements Gathering:

Through workshops and discussions, we will gather detailed requirements for data storage, data integration, data processing, reporting, and analytics. This ensures that the data architecture meets your organization’s unique needs.

04. Architecture Design:

Based on the requirements, we will design a comprehensive data architecture that outlines how data will flow, be stored, transformed, and utilized. This includes defining data layers, data sources, integration points, and data flow diagrams.

05. Data Modeling:

We will create logical and physical data models that reflect your organization’s data structures and relationships. These models serve as a blueprint for database design and development.

06. Technology Selection:

We will evaluate and recommend appropriate technologies and tools for your data architecture. This may include database management systems, data warehouses, data lakes, ETL (Extract, Transform, Load) tools, and more.

07. Data Integration:

Integrating data from disparate sources is a key challenge. We will design integration strategies to ensure smooth and accurate data flow, reducing data silos and enabling a holistic view of your data.

08. Data Transformation:

We will design data transformation processes to cleanse, enrich, and standardize data as it moves through the architecture. This ensures data quality and consistency for reporting and analysis.

09. Scalability and Performance:

We will optimize the architecture for scalability and performance. We will consider factors such as data volume, query complexity, and response time to ensure efficient data processing.

10. Security and Compliance:

Data security and compliance are paramount. We will implement security measures, access controls, encryption, and other safeguards to protect sensitive data and ensure regulatory compliance.

11. Metadata Management:

We will establish metadata management practices to document and catalog data assets, providing context and lineage information. This enhances data governance and enables better data discovery.

12. Cloud Migration and Strategy:

If applicable, we will migrate to cloud-based data architecture. We will also develop cloud migration strategies and leverage cloud services for scalability, flexibility, and cost savings.

13. Change Management and Training:

Implementing a new data architecture often requires changes in the institutional investment firm’s culture and processes. We will provide change management strategies and training to ensure smooth adoption.

14. Monitoring and Optimization:

After implementation, we will monitor the data architecture’s performance and health. We will also identify areas for optimization, fine-tune processes, and recommend improvements.

15. Documentation and Knowledge Transfer:

Last but certainly not least, we will document the data architecture design, processes, and best practices. We will also provide knowledge transfer to your internal team, ensuring sustainable management and maintenance.

MDM Selection & Implementation

At Cognivo, we have been providing valuable consulting in Master Data Management (MDM) selection and implementation, ensuring that your institutional investment firm effectively manages and maintains consistent and accurate master data across systems. Here’s how Cognivo is helping other the investment management industry with MDM selection and implementation:

01. Needs Assessment:

We will work closely with your organization to understand your specific MDM needs, challenges, and business objectives. We will conduct thorough assessments of your current data landscape and data governance practices.

02. Vendor Evaluation:

We will evaluate MDM software vendors based on your requirements. We will consider relevant factors such as data domains, scalability, integration capabilities, user experience, and total cost of ownership.

03. Solution Design:

Based on your needs, we will design an MDM solution architecture that aligns with your organization’s data governance goals. This includes defining data domains, hierarchies, relationships, and data ownership.

04. Data Governance Framework:

We will establish a data governance framework that outlines roles, responsibilities, and processes for managing and maintaining master data. We will develop data governance policies and workflows.

05. Data Profiling and Cleansing:

As part of implementation, we will profile and cleanse existing master data to ensure accuracy and consistency. This involves identifying data quality issues and taking corrective actions.

06. Data Mapping and Integration:

We will design data mapping and integration strategies to synchronize master data across different systems and applications. We will also ensure seamless data flow and reduce data discrepancies.

07. Customization and Configuration:

MDM solutions often require customization to meet specific business needs. We will configure the MDM software and develop custom workflows, validation rules, and user interfaces.

08. Data Matching and Deduplication:

We will implement data matching and deduplication algorithms to identify and merge duplicate records within the master data repository.

09. Data Quality Measurement:

We will establish data quality metrics and measurement processes to continuously monitor and improve the quality of master data.

10. Change Management and Training:

MDM implementation often requires changes in processes and user behavior. We will provide change management strategies, user training, and communication plans to ensure smooth adoption.

11. Metadata Management:

We will create metadata repositories that document the definitions, relationships, and lineage of master data elements. This enhances data understanding and traceability.

12. Scalability and Performance:

We will optimize the MDM solution for scalability and performance, ensuring it can handle growing volumes of master data and user interactions.

13. Security and Compliance:

We will implement security measures and access controls to protect sensitive master data. We will also ensure compliance with data protection regulations.

14. Monitoring and Maintenance:

After implementation, we will establish monitoring mechanisms to track MDM performance, data quality, and user interactions. We will also provide ongoing support and maintenance to address issues and make enhancements.

15. Measurement and Continuous Improvement:

We will define key performance indicators (KPIs) to measure the success of your MDM implementation. We will provide insights and recommendations for continuous improvement.

Data Governance Design & Implementation

Data governance ensures that data is managed, protected, and used effectively to drive business value. Here’s how Cognivo is helping the investment management industry with data governance:

01. Assessment and Strategy Development:

We will start by assessing your organization’s current data governance practices, policies, and challenges. We do this by working with stakeholders to understand business goals and develop a tailored data governance strategy.

02. Policy and Framework Creation:

We will create comprehensive data governance policies, frameworks, and guidelines. These documents outline roles, responsibilities, processes, and standards for data management, privacy, security, and compliance.

03. Data Ownership and Stewardship:

We will assist in defining data ownership roles and responsibilities, assigning stewards for different data domains, and establishing processes for data stewardship and accountability.

04. Metadata Management:

We will establish metadata management practices, creating repositories that document data definitions, lineage, and relationships. This enhances data understanding, traceability, and consistency.

05. Data Classification and Standards:

We will work with your organization to classify data based on sensitivity, importance, and usage. We will also develop data standards and naming conventions to ensure consistency and facilitate data discovery.

06. Data Quality Management:

We will design data quality frameworks and processes, including data profiling, validation, and cleansing. We will also help implement procedures to monitor and improve data quality over time.

07. Data Security and Privacy:

We will define data security measures, access controls, encryption, and data masking techniques to protect sensitive information. They ensure compliance with data protection regulations (e.g., SEC, FINRA).

08. Change Management:

Implementing data governance often requires changes in processes and organizational culture. We will provide change management strategies, communication plans, and training to promote adoption.

09. Data Governance Committees:

We will establish data governance committees or councils composed of key stakeholders. These groups oversee data governance initiatives, make decisions, and ensure alignment with business goals.

10. Data Governance Tools and Technologies:

We will recommend and implement data governance tools that support data cataloging, data lineage, data quality monitoring, and collaboration among data stewards.

11. Performance Measurement:

We will define key performance indicators (KPIs) for data governance success. We will also develop metrics to measure data quality, compliance, user adoption, and the impact of data governance efforts.

12. Education and Training:

We will provide training sessions, workshops, and resources to educate employees about data governance principles, practices, and the importance of data stewardship.

13. Data Governance Roadmap:

We will create a strategic roadmap for data governance implementation and maturity. This roadmap outlines milestones, timelines, and steps for evolving data governance practices.

14. Continuous Improvement:

We will establish processes for continuous improvement of data governance initiatives. We will also facilitate regular reviews, audits, and refinements to ensure ongoing effectiveness.

15. Governance for Master Data Management (MDM):

If your organization employs MDM, we will integrate MDM governance into your overall data governance framework to ensure consistency and accuracy of master data.

Data Analytics & Investment Research

Here’s how Cognivo is helping the investment management industry in each of these areas:

Data Analytics

16. Needs Assessment:

We will work with your firm to understand your business objectives and data-related challenges. We will assess your data sources, infrastructure, and analytics requirements.

17. Strategy Development:

We will define a data analytics strategy that aligns with your goals. This may involve identifying key performance indicators (KPIs), data sources, and analytics techniques.

18. Data Collection and Integration:

We will assist in collecting and integrating data from various sources, including internal databases, external APIs, and third-party data providers.

19. Data Preparation and Cleansing:

We will clean, preprocess, and transform the data to ensure its quality and reliability for analysis.

20. Analysis and Visualization:

We will conduct advanced data analysis using statistical methods, machine learning, and other techniques. We will create visualizations and dashboards to communicate insights effectively.

21. Predictive and Prescriptive Analytics:

We will build models that predict future trends or prescribe optimal actions based on historical data, helping you make informed decisions.

22. Business Insights:

We will provide actionable insights from the analysis, helping you identify opportunities, optimize processes, and improve decision-making.

23. Training and Adoption:

We will train your team on data analytics tools, techniques, and best practices, ensuring your organization can continue to leverage data effectively.

Investment Research

01. Market Research:

We will gather and analyze data on market trends, industry benchmarks, and competitor analysis to inform investment decisions.

01. Financial Analysis:

We will conduct financial modeling, valuation, and risk assessment to evaluate investment opportunities.

02. Data-driven Investment Strategies:

We will develop data-driven investment strategies based on historical data, economic indicators, and quantitative analysis.

03. Portfolio Optimization:

We will design and optimize investment portfolios by considering risk-return trade-offs and diversification strategies.

04. Alternative Data Integration:

We will explore and integrate non-traditional data sources (e.g., social media sentiment, satellite imagery) to gain unique insights for investment research.